Welcome to the Emerald City newsletter, I will post a new investment idea monthly. My first deep dive is on Spire Global currently trading as a special purpose acquisition company, ticker NSH. Please send your feedback and comments.

Spire Global may be the coolest company you've never heard of. Spire operates a constellation of multi-sensor small satellites, gathering data and intelligence on Earth from orbit. Investors have an opportunity to acquire shares at NAV while Spire goes through the de-Spacing process. An investment thesis in Spire is based upon the following:

The small satellite industry is at a critical tipping point for technological innovation

Spire sells differentiated vertical based solutions and extends their platform with native APIs

Spire has the right business model to scale with best-in-class growth and unit economics

Greenfield opportunity in defining a potentially massive market supported by environmental demands

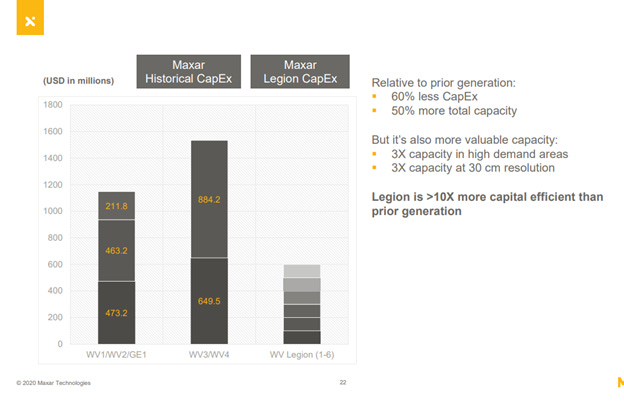

Spire operates in the earth observation industry, providing and selling unique data about the earth taken from satellites. Historically, earth observation data has been gathered by large and expensive satellites photographing the earth from lower earth orbit (LEO). This data is primarily sold to governments for intelligence and military applications. Maxar technologies the largest provider of high-resolution imagery counting the US government as its largest customer. Maxar’s latest generation of satellites, WorldView Legion, costs a whopping $600M for the first six satellites. This is a significant improvement from the previous generations which where over 6x as expensive. Although the costs and technology are improving overtime, new satellites still take years to develop which limits innovation and iteration.

As a different approach, small satellite architecture enables faster deployment into space, rapid iteration, all at a fraction of the cost. Will Marshall, the CEO of the unicorn Planet, laid out the cast for small satellites well seven years ago, comparing old satellites as a mainframe computer. The full Ted Talk from 2014 is worth a listen.

While the concept of small satellites is not new, we may now be at a critical tipping point for mass commercial adoption of small satellite technology for several reasons:

Commercial launch companies are innovating to lower the cost to access Space. SpaceX is leading the industry to develop reusable rocket technology to dramatically reduce the cost, followed by many others including Rocket Lab.

Small satellites are now capable of doing exponentially more. Continuous improvements in technology and microchips delivers increasing performance per inch on a satellite, essentially Moore’s law applied to satellites.

Machine learning and cloud computing industry is now capable of analyzing and processing massive amounts of data. Advances in machine learning and cloud computing will enable developers to make better use of geospatial data for previously unthought use cases.

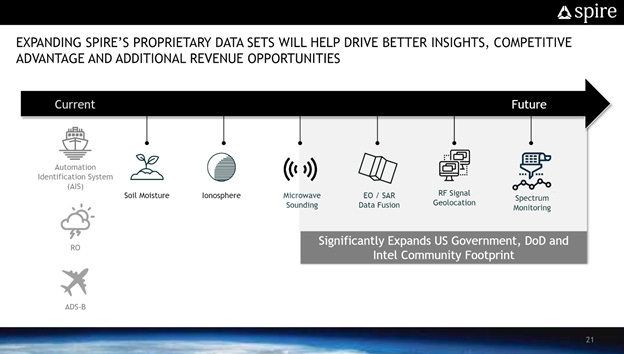

Spire along with Planet are leading in the development of small satellites for earth observation. Rather than focus on optical images of the earth, Spire’s approach has been to develop multi-sensor satellites providing weather forecasts, and tracking ships and airplanes in real-time. Spire operates and sells this value-add data into several verticals and provides APIs to developers to build-up their data. Overtime, Spire can expand into additional data sets and services they provide to new and existing industry verticals.

Spire also provides orbital services, enabling customers to leverage Spire’s satellite platform and infrastructure rather than build their own, shortening time to market (Space-as-a-service). Orbital services allows Spire to sell capacity as a platform and extend into new use cases. For example, Spire has partnerships with OroraTech and Australian ONI

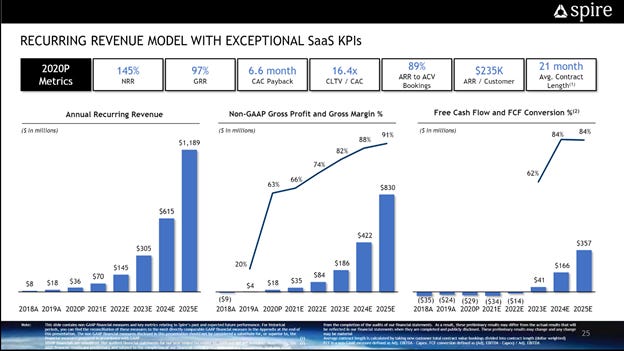

Spire has the right business model to grow and invest in R&D. Spire develops industry specific solutions and sells these solutions as a subscription creating operating leverage the business. Spire’s disclosed business metrics are competitive with some of the most best SaaS companies in the market.

Sales efficiency is a standout metric with sales and marketing 28% of ARR, with ARR growing 100%! A CAC payback period of 6-7 months is excellent, implying the cost to acquire a customer is low. In addition customer retention is very sticky with a net retention rate of >145% and gross retention rate of 97%. Excellent unit economics will enable Spire to rapidly innovate and invest R&D in new opportunities, while growing the business.

In the public market today, a SaaS company with these metrics trades at 30–40x ARR. To see how Spire stacks-up Meritech has a good dashboard of public SaaS companies: SaaS Public Comparables

One significant question remains. How large really is the market opportunity? In order for Spire to grow into its valuation, there needs to be a significant market.

The market may be huge for the simple reason that space provides the unique vantage point to measure and understand our environment. Solving climate change is set to be one of the most important problems humans have ever faced. Investments and new companies will develop to help fight this change, and Spire can be one of them. Today, Spire is helping reduce fuel consumption in maritime through digital twining, forecasting weather to support wildfire management, or using vessel data to combat illegal fishing. Spire overtime can expand into new data sets and vertical solutions.

All of this makes Spire worthy of consideration and attention as Spire’s goes through the de-SPACing process. The company is valued at a $1.2B EV and 16x forward ARR (assuming they maintain ~100% YOY growth as forecasted). Spire has the rare opportunity to not only maintain low triple digit growth rates, but also a potential to re-rate higher in-line with public SaaS companies.

Thanks for reading, please leave comments or feedback!

Disclosure: I am long (NSH). This is not investment advice.

short and crisp